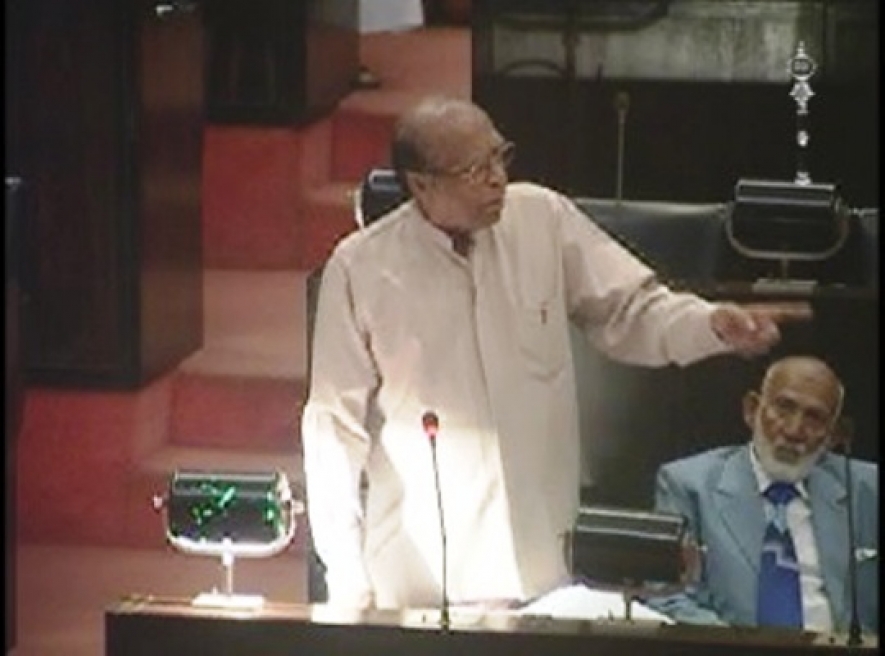

The Minister participating in the Second Reading stage debate on budget 2015 said that budget 2015 is an all inclusive budget for it had embraced all segments of society and all sectors, area, and regions of the economy.

“For the first time in a budget the highest national priority consideration was given to the development of human resources comprehensively. I am particularly happy as Minister of Human Resources that the policy presented by me to the Cabinet and to this House is now on its top gear in full implementation. All areas of human resources development have been covered by the budget.”

He said that the budget 2015 has for the first time fully covered the informal economy being a sub-sector of the private sector which was hitherto neglected both by the government and society. “All previous budgets since independence have been concentrating on the public sector and the private sector of the formal economy. I have been repeatedly demanding in my previous speeches at the budget debates to shift the emphasis on the much neglected information economy and I am happy that this has been done.”

Senior Minister Gunasekera said that tax evasion in Sri Lanka is both intensive and extensive and paves way for colossal and massive financial and social problems.

The Minister said that tax evasion could not be combated excepting through revision of tax policy and tax structures. “This massive tax evasion has brought in its train wide disparity of income and wealth. This has resulted in an in-built structure of inequality in the society, the main source of social erosion and cultural degradation. It is necessary to address this question through the prism of political economy rather than through macro-economics,” the minister said.

“As an ex-tax man, I have been repeatedly demanding on the floor of this House a revision of tax policy, tax structure and tax laws and an overhaul change in tax administration,” the minister said.

He said: “Even though we have been able to reduce the budget deficit to a manageable level, the frat remains that we shall not be able to create a strong national revenue and consolidate the macro-economy unless we raise our government revenue beyond 16% and well towards 20%. With all out efforts, we have not been able to arrest the downwards trend in the government revenue. Despite all simplifications of tax laws and tax rates, the tax base is still narrow owing to a number of factors such as wide-ranging exemptions, tax rate structure, non-compliance, inadequate enforcement, unethical business and tax practices etc.”

The minister said that taxation was not only a method of collecting revenue but also an instrument to contain inflation, inequality and high trends of consumerism.

“As Chairman of COPE, it inspires me to find that of total strategic state-owned public enterprises including financial enterprises being 55, only eight enterprises will incur losses for 2014. This is very encouraging in contrast with previous years,” the minister added.

“On the eve of the Budget, there were massive demonstrations and picketing demanding higher wages and various reliefs. The government magnanimously responded to them with relief and solutions. This is in utter contrast with the one-day token general strike of July 1980 which nearly one lakh of workers were dismissed for demanding a meager Rs 10 a day,” he said.

“As we move forward to a middle income country, we are required by the dynamics of the economy to effect structural changes in order to meet with the impeding challenges,” he added. (Special Reporter/HC)