The GWP for Long Term Insurance and General Insurance Businesses for the 1st half of 2018was Rs. 85,755 million compared to the 1st half of 2017 amounting to Rs. 76,162 million posting a growth of 12.60% (1st half 2017: 13.87%).The GWP of Long Term Insurance Business amounted to Rs. 37,902 million (1sthalf 2017:Rs. 33,657 million) recording a growth of 12.61% (1st half 2017: 11.06%).

The GWP of General Insurance Business amounted to Rs. 47,853 million (1st half 2017: Rs. 42,505million) recording a growth of 12.58% (1st half 2017: 16.20%).

The value of total assets of insurance companies has increased to Rs. 581,770million as at end of 1st half of2018, when compared toRs. 533,075millionrecorded as at end of 1st half of 2017, reflecting a growth of 9.13% (1st half 2017: 11.42%).The assets of Long Term Insurance Business amounted to Rs. 407,708 million (1st half 2017: Rs. 375,159 million) indicating a growth rate of 8.68% year-on-year.However, the growth of assets of long term insurance business has significantly dropped compared to 15.93% growth recorded during 1st half of 2017.

The assets of General Insurance Business amounted to Rs. 174,062 million (1st half 2017: Rs. 157,915 million) depicting a growth rate of 10.23% (1st Half 2017: 2%) at the end of 1st half of 2018. Accordingly, the growth of assets of general insurance business has shown a significant increase compared to the same period of 2017.

At the end of 1st half of 2018, investment in Government Debt Securities amounted to Rs. 176,471 million representing 47.48% (1st half 2017: Rs. 175,627;51.32%) of the total investments of Long Term Insurance Business, while such investment of the total investment of General Insurance Business amounted to Rs. 42,486 million representing 37.98%.

Accordingly, the total investment of both Long Term Insurance Business andGeneral Insurance Business in Government Securities amounted to Rs. 218,957million (1st half 2017: Rs. 211,599million).

Thus, the investment in Government Securities of Long Term Insurance Business and General Insurance Business has increased by 0.48% and 18.11% respectively.

The claims incurred by insurance companies during the 1st half of 2018 in both Long Term Insurance Business andGeneral Insurance Business was Rs. 38,422 million (1st half 2017:Rs. 32,249 million) showing an increase in total claims amount by 19.14% year-on-year. The Long Term Insurance claims, including maturity and death benefits, amounted to Rs. 16,104 million. The claims incurred in General Insurance Business, including Motor, Fire, Marine and other categories, amounted to Rs. 22,318 million.

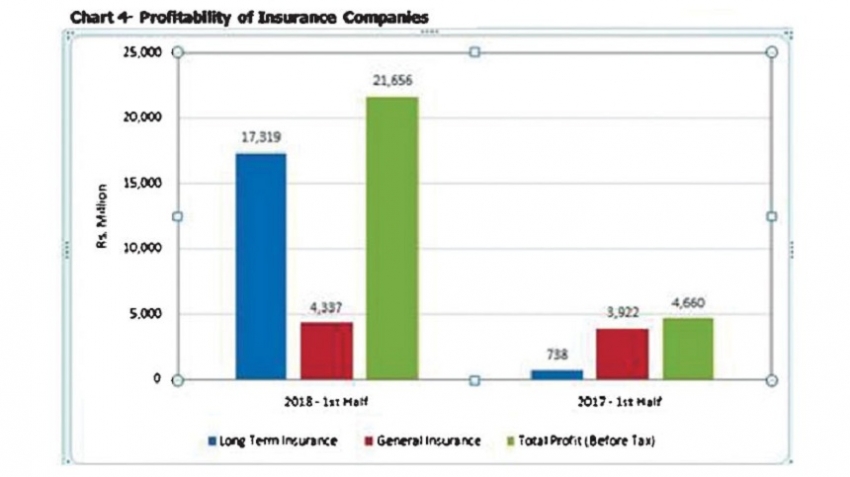

The profit (before tax) of insurance companies as at end of 1st half of 2018in both Long Term Insurance Business andGeneral Insurance Business amounted to Rs. 21,656million (1st half, 2017: Rs. 4,660 million) showing anincrease in total profit amount by 364.71%.The profit (before tax) of Long Term Insurance Business amounted to Rs. 17,319 million (1st half 2017: Rs. 738 million) while the profit (before tax) of General Insurance Business amounted to Rs. 4,337 million. Thus, profit (before tax) of Long Term Insurance Business and General Insurance Business has increased by 2,246.57% and 10.57% respectively.

Out of twenty-six (26) insurance companies in operationas at 30th June2018, twelve are engaged in Long Term (Life) Insurance Business, twelve companies are carrying out only General Insurance Business and two are composite companies.

Fifty-nine insurance brokering companies, registered with the Commission as at 30th June2018, mainly concentrate in General Insurance Business. The premium income generated through insurance brokering companies in the 1st half of 2018 with respect to General Insurance Business amounted to Rs. 11,560 million, 13.48% of total GWP (1st half 2017: Rs. 9,915 million; 13.01% of total GWP) while the premium income generated with respect to Long Term Insurance Business amounted to Rs. 353 million, 0.41% of total GWP.

The total premium income generated through insurance brokering companieswith respect to both General Insurance and Long Term Insurance Businesses amounted to Rs. 11,913 million, 13.89% of total GWP, during 1st half of 2018, compared to Rs. 10,055 million, 13.20% of total GWP during the 1st half of previous year.