The officials representing the Inland Revenue Department said that the majority of the income deficits were to be paid by government institutions and that an independent board has determined that some of these institutions are currently not in a financial position to pay the relevant revenue. Accordingly, the Committee recommended the Income Revenue Department to submit a full report on these institutions.

The Auditor General's Department pointed out that another reason for this substantial deficit of revenue was due to 8060 dishonored cheques worth Rs. 3 billion. The Inland

Revenue Department officials pointed out at the committee that a blacklist inclusive of 65 taxpayers has already been prepared.

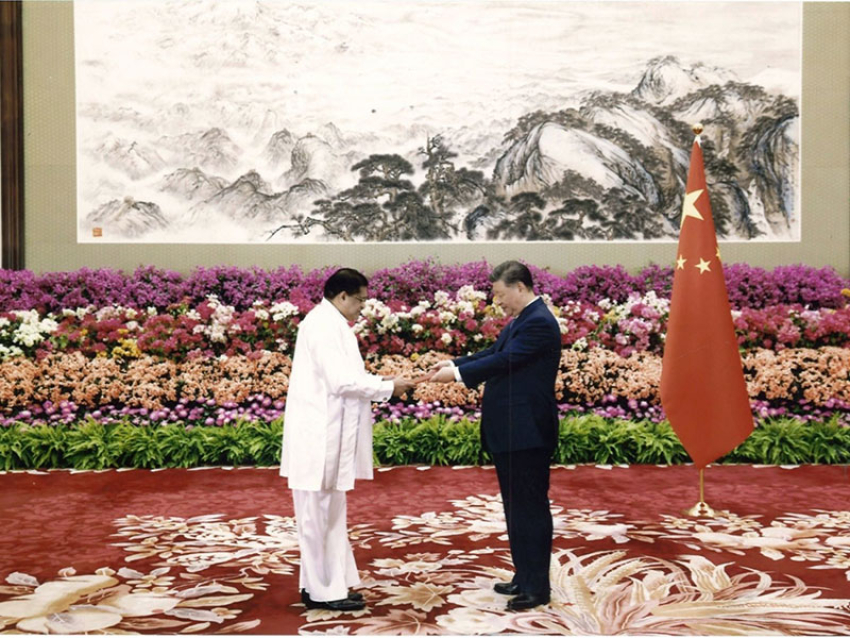

The Inland Revenue Department was summoned before the Committee on Public Accounts yesterday and presence was marked by a number of Ministers, Members of Parliament, Secretary to the Treasury and Ministry of Finance S. R Attygalle, the Commissioner General of Inland Revenue C. P. J. Siriwardena and many high-ranking officials of the Inland Revenue Department and the Auditor General's Department.

Officials stated that since the beginning of 2017, the Inland Revenue Department has utilized a computerized system called RAMIS to streamline tax collection process which has

been more efficient than conducting the process manually.

However, Hon. Members pointed out that it is problematic that more than Rs. 3 billion should be paid again to a Singaporean company every time a tax amendment is made to the

said system which was established at a cost of over Rs. 4 billion. Therefore, Minister Duminda Dissanayake suggested that an agreement on tax amendments should be arrived

for a one-time payment mechanism with the company.

Secretary to the Treasury and Ministry of Finance S. R Attygalle pointed out that a five-year continuous, consistent tax policy was proposed by this budget for the practical convenience of taxpayers as well as tax collectors.

According to the officials, there are 2,192 large-scale taxpayers in Sri Lanka, of which 532 contribute towards the payment of 70.2% of tax revenue.

Minister of State Lasantha Alagiyawanna, Duminda Dissanayake as well as Members of Parliament Tissa Attanayake, Gunapala Ratnasekera, Weerasumana Weerasingh, Prof. Ranjith Bandara, Ajith Rajapakse, S. Shritharan and Harini Amarasuriya were present at the meeting.