This action resembles the recent unwarranted downgrade by Moody’s Investors Service a few days prior to the announcement of the National Budget 2022. The sense of urgency on the part of an internationally recognised rating agency to downgrade Sri Lanka is inconceivable, particularly considering the fact that Fitch was being constantly updated by Sri Lankan authorities on the latest developments in all sectors of the economy and imminent foreign exchange inflows.

In particular, despite the lockdown measures that had to be introduced in the third quarter of 2021, the real economy averted a deep contraction during the quarter, signalling Sri Lanka’s adaptability to the new normal. Real GDP, in fact, expanded by 4.4 per cent (year-on-year) during January-September 2021, reaffirming the strong possibility of above 4 per cent growth in 2021. High frequency data on activity point towards a strong recovery of the economy surpassing the pre-pandemic level. The Manufacturing Purchasing Managers’ Index reached 61.9 in November 2021, the highest reading for a month of November on record, and way above the pre-pandemic level of activity. Indices of the Colombo Stock Exchange reached historical highs, with a large number of Initial Public Offerings taking place in 2021. Credit extended to the private sector expanded by over Rs. 685 billion in the ten months to October 2021, compared to about Rs. 260 billion in the same period last year.

The trade deficit continued to decline from May 2021 on a month-on-month basis, supported by record high export earnings. Earnings from merchandise exports recorded an all time high in October 2021, and preliminary information indicates that earnings have exceeded this record level in November 2021. With the exchange rate remaining stable since April 2021, excepting a few speculation-driven deviations, the conversion of export proceeds and other foreign exchange earnings has also improved substantially in recent weeks. An exponential growth in tourist arrivals is observed on a monthly basis, indicating an early reversal of the annual foreign exchange revenue loss of around US dollars 5 billion in the period ahead.

The prospects for workers’ remittances are bright, with the resumption of worker migration, increased demand for Sri Lankan workers particularly from the Middle East and efforts to facilitate worker remittances through formal channels through an attractive incentive package. With such measures, the external current account balance is expected to be maintained at growth supporting levels, thereby accommodating equity capital to the financial account through direct investment to the identified projects in the Colombo Port City and Industrial Zones, in addition to the expected monetisation of non strategic and underutilized assets.

These developments and the rapid vaccination drive, which is being rolled out nationally, would help realise the potential of the economy over the near to medium term.

Fitch has also failed to recognise the fiscal reforms introduced through the National Budget 2022. With the introduction of new tax measures, upgraded tax administration systems, and the revival of the economy, the year 2022 is expected to deliver a substantial increase in Government revenue. Increasing the retirement age of public sector employees and measures to enhance the viability of state owned business enterprises are notable reforms, and issuing quarterly warrants for Government institutions instead of annual warrants are expected to instill financial discipline in the utilisation of the allocations, thereby cushioning the expenditure side. Such revenue and expenditure side measures would pave the way for a reduction in the fiscal deficit and financing needs of the Government, contributing to a sustainable debt level.

The domestic market has responded positively to expected path of fiscal consolidation, and interest rates have stabilised, following an initial overshooting, at market clearing levels. The Central Bank’s holdings of Government securities have also declined notably as a result of improved subscription at primary market auctions and active open market operations.

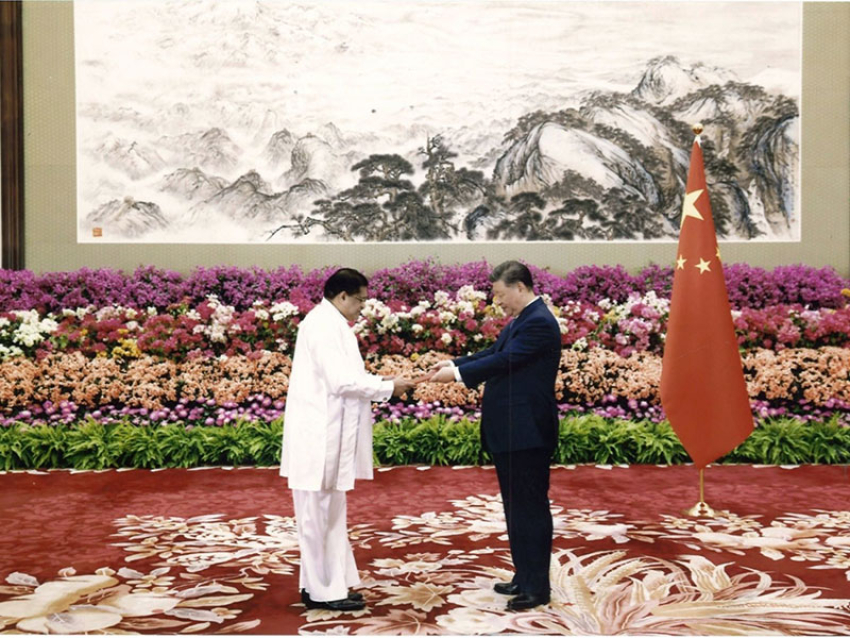

Contrary to Fitch’s unfounded claims on increased probability of a default event over the coming months, the measures undertaken by the Government and the Central Bank to secure support from friendly nations in the region are nearing fruition, thereby offsetting pressures on the balance of payments in the period ahead. The Six-Month Road Map for Ensuring Macroeconomic and Financial System Stability clearly articulated the expected cashflows by December 2021 and by March 2021, and the Government and the Central Bank remain confident that these inflows will materialise, and the end-2021 level of Gross Official Reserves will remain above US dollars 3 billion. Fitch appears to have completely ignored the standby SWAP facility with the People’s Bank of China of around US dollars 1.5 billion, of which the drawal is imminent. The credit lines and other inflows expected following high-level meetings in India and the Middle Eastern and other regional economies are also not given due consideration by Fitch in arriving at this decision.

The fact that Fitch Ratings decided to downgrade Sri Lanka without waiting until the first test date of 31 December 2021 shows nothing but recklessness, which could only hurt investors if decisions are made based on this downgrade. It must also be noted that the Government has given a clear assurance that Sri Lanka will honour all debt obligations in the period ahead, and Sri Lanka has not delayed a single payment even under severe stresses that were caused by the COVID-19 pandemic over the past two years.

Therefore, all stakeholders of the economy, including international investment partners, are requested not to be dissuaded by this unjustified rating action, but instead, work with Sri Lanka to surf the turbulent tides, which are expected to settle in the next few days. A detailed Press release on the progress of expected foreign inflows as envisaged in the Six-Month Road Map will be published this week.

Published Date:

Saturday, December 18, 2021