Sri Lanka introduced a low tax regime in late 2019. The reforms included the reduction of tax rates of Value Added Tax (VAT), Personal Income Tax (PIT) and Corporate Income Tax (CIT), and narrowing tax bases of VAT and PIT, while introducing a plethora of tax incentives, such as tax exemptions for agriculture and Information Technology (IT) and enabled services, tax deductions and tax holidays. This caused an annual loss of around LKR 600 billion – 800 billion in tax revenue to state coffers.

Therefore, these reforms are now being looked as policies that led to a significant loss of government revenue, partly due to the spread of COVID-19 pandemic in 2020/2021 and related developments, which affected the revenue generation process, ultimately resulting in the lowest revenue to GDP ratio in the region. The revenue to GDP ratio has declined to 9.1 percent in 2020 from 12.7 percent in 2019 and further deteriorated to 8.7 percent in 2021. This is significantly lower than the average revenue ratio of around 25 percent of GDP in emerging market and developing economies.

The low tax regime, the impact of the COVID-19 pandemic on revenue mobilization, together with the pandemic relief measures, widened the budget deficit significantly to 11.1 percent of GDP in 2020 and 12.2 percent of GDP in 2021 from 9.6 percent of GDP in 2019. This has led to an increase in the government debt to GDP ratio to 100.6 percent in 2020 and 104.6 percent in 2021 from 86.9 percent in 2019.

This fiscal imbalance has significant adverse spillover effects over the economy. Sri Lanka’s economic outlook remains vulnerable with the unprecedented inflationary pressures, persistently large fiscal and balance of payment financing needs, large debt overhang and critically low level of reserves and pressures on the exchange rate. Economic growth will be adversely affected by the foreign currency shortage and ensuing economic conditions prevailing in the country as well as loss of business and investor confidence due to credit rating downgrades.

The loss of access to international markets and the relatively low amount of other foreign exchange inflows to the government have created substantial issues in financing the government budget deficit. In 2020 and 2021, the entire budget deficit was financed through domestic sources as there were net repayments to the foreign sources. Of the domestic sources to finance the budget deficit, the majority was obtained from the banking sources, particularly from the Central Bank of Sri Lanka, given the unavailability of sufficient amount of net financing in the domestic non-bank sources. Continuous significant amount of Central Bank monetary financing has adversely affected the economy, particularly with the significant pressure on the inflation and the exchange rate.

At present, the situation has aggravated to a very critical level where the General Treasury has to increasingly obtain Central Bank financing to make the government expenditures, including a substantial part of interest, salaries and wages, pensions and Samurdhi payments etc. This is clearly unsustainable and hence the implementation of a strong fiscal consolidation plan is imperative through revenue enhancement as well as expenditure rationalization measures in 2022 and beyond to ensure macroeconomic stability to support the medium to long-term economic growth objectives of the country.

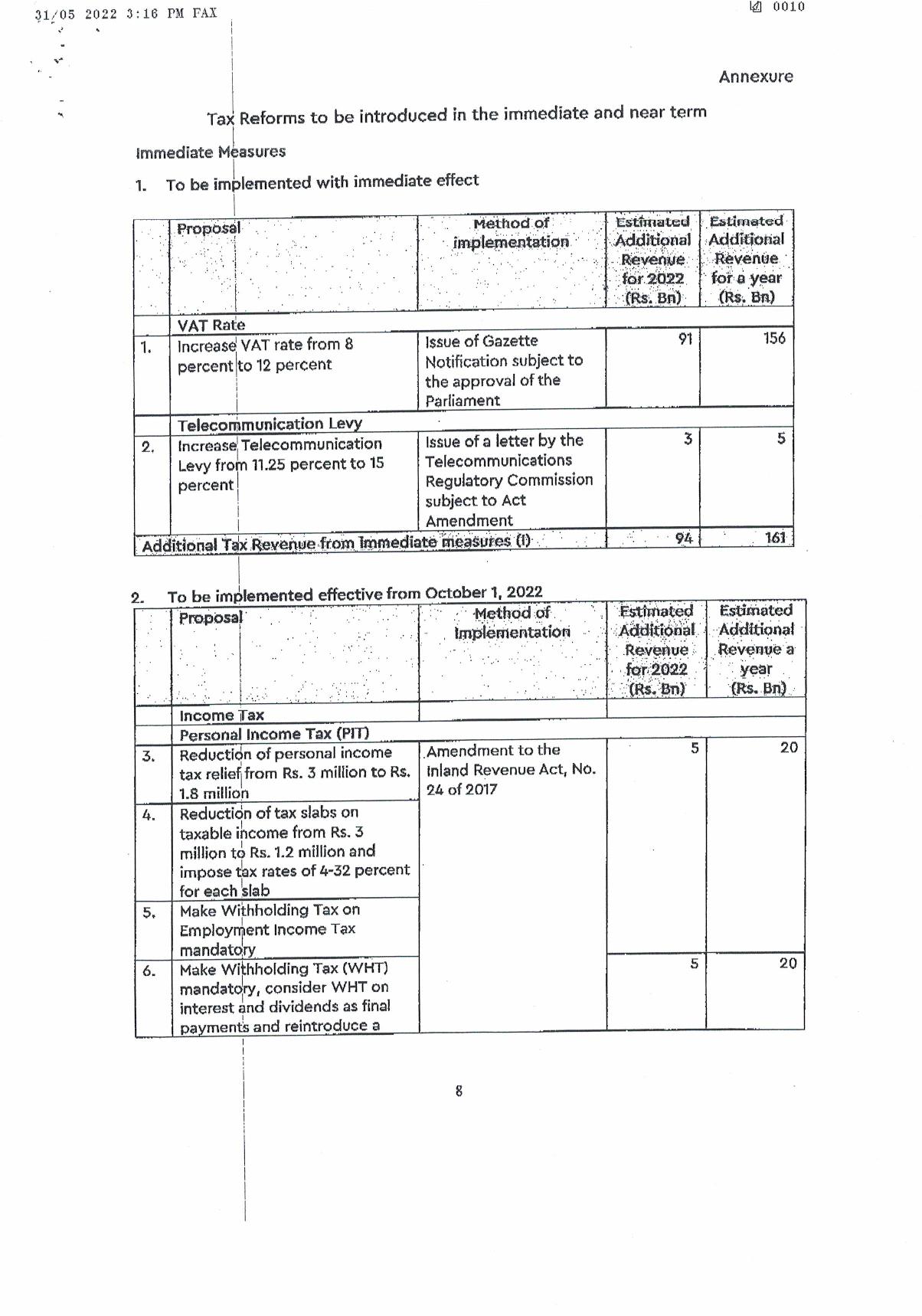

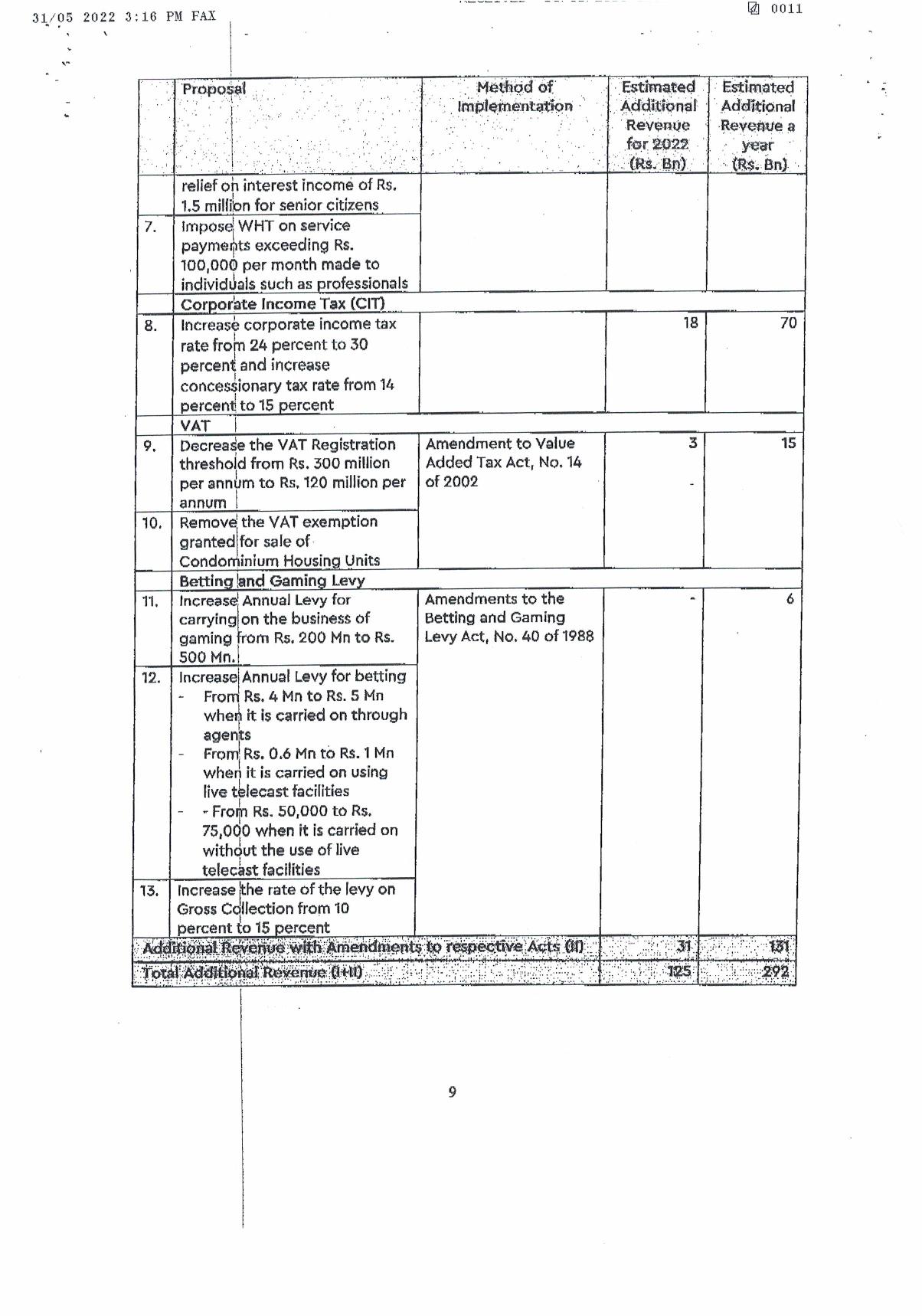

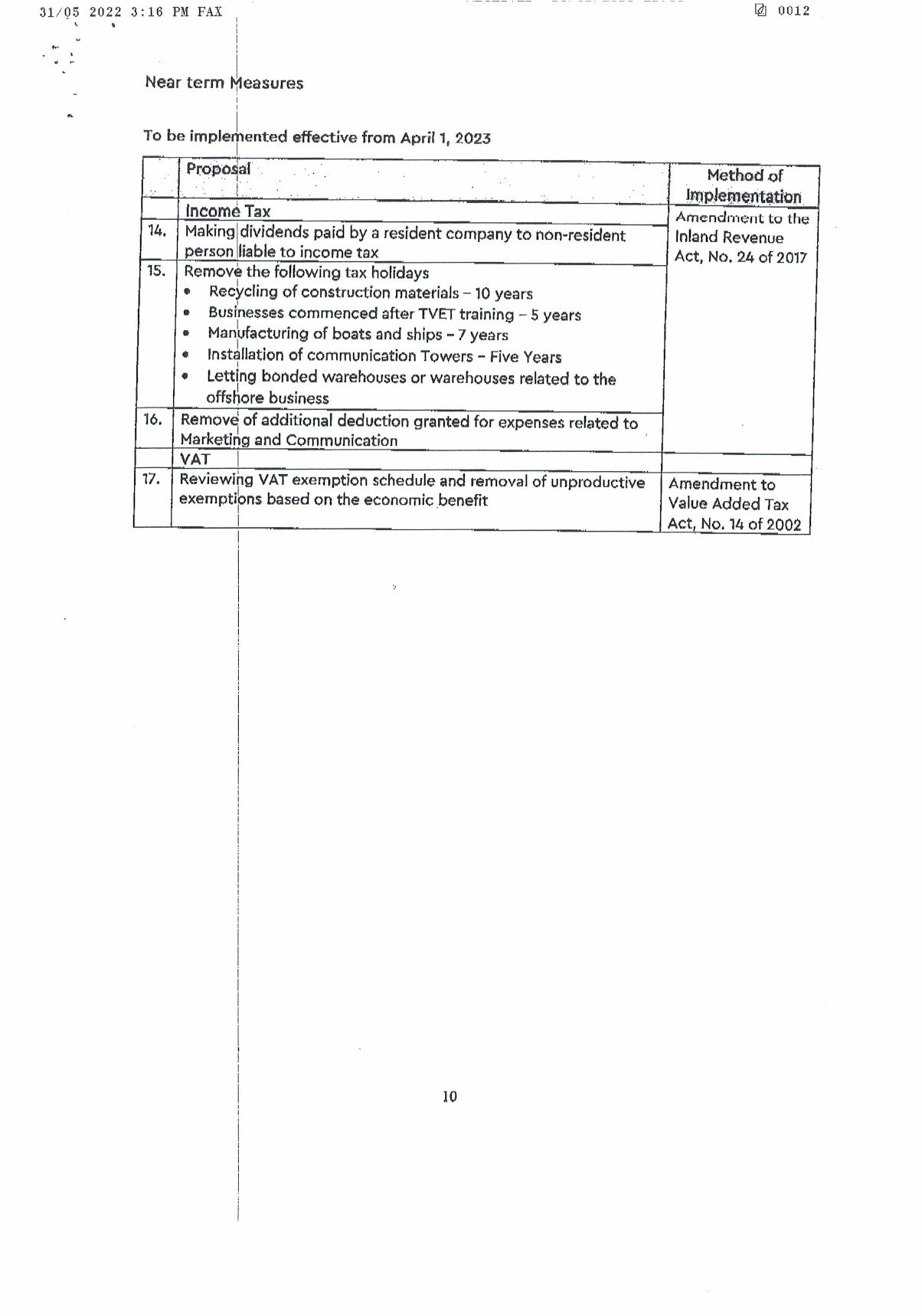

In the above background, the following tax reforms are proposed to be implemented over the immediate and near term. Please find annexures attached below.

Prime Minister's Media Division