He said Sri Lanka faced limited access to financing and took ownership of its debt and economic restructuring program. The president emphasized the need for timely and automatic access to concessional financing and highlighted the high costs incurred during the process. He also called for improved interaction between creditors and debtors and suggests a new approach to address geopolitical issues.

President Wickremesinghe emphasized the urgency of restructuring to avoid instability and advocated for a separate process for middle-income countries to address their unique challenges.

He expresses gratitude for the IMF’s intervention and Sri Lanka’s coordination, which allowed dealing with both creditor groups. Ongoing negotiations with Japan, India, and China regarding trade integration and development programs also aided the process. However, President Wickremesinghe highlights the need for improved interaction between the committee and debtors during the restructuring process, suggesting that a new approach is necessary.

Following is an excerpt of the question posed by the Moderator First Deputy Prime Minister of Spain Nadia Calvino at the panel discussion and the response by President Wickremesinghe;

Q. So President Wickremesinghe, you are in a somewhat special situation. We move now into a middle-income country The coordination challenges are maybe, greater in the sense that you are not subject to the common framework, which is heard that it was an important instrument in the case of Chad. The official creditor committee has been formed with Paris Club and non-Paris Club members and we understand that India’s decision to participate and co-chair these creditors gathering is a major milestone. So what is your view about the restructuring process and what do you consider to be the main bottlenecks? We have already heard from the President of Chad that we need to reduce bureaucracy and we all agree on that. Simplification is sometimes the most complex thing to achieve. But, we are very interested to hear your experience in this regard.

A. When Sri Lanka was declared bankrupt as a middle-income country, we were not eligible under the common framework for debt restructuring. We had limited access to concessionary financing and there was a complete loss of external financing. Therefore, Sri Lanka’s response was to take ownership of this program, both for debt restructuring as well as the economic restructuring needed for growth. Then we negotiated our conditionality with the IMF and the creditors.

So, it’s like we were working on a menu, the argument of what are the items that should get on and what are the items that could be taken off. I think we had an agreement actually to about 90% of the items. So, we own it as much as the IMF is. Of course, we had two exceptional situations.

One is that India came to our help and that was nearly four billion US dollars available when no other source of funding was available. Secondly, through the World Bank and the ADB, we went through the process of reverse graduation.

So the gain became entitled to concessionary funding. But from the time we declared ourselves bankrupt, there was a delay in bureaucracy on both sides. We delayed and if we had funding by May, the upheavals of July could have been avoided.

But anyway, we had the upheavals of July. We went in immediately as it settled down. By September, we had a staff-level agreement, but it took us another six months for the agreement to come before we got any monetary assistance.

So, we undertook significant economic reform that imposed pain on the population but without any predictability. Now, this is the problem we have. I would say given the increasing vulnerabilities facing middle-income nations, MIC’s access to concessional financing must be viewed from a broader perspective. That is access to an automatic and timely, under an agreed criterion. If you fulfill the criteria.

Secondly, I mean, I agree President Acharya defined it. We could have done it much faster.

We did the debt. The staff level agreement came last September. By November, we had the climate prosperity plan, which we announced at COP 27. Now, it’s been followed up by Sri Lanka’s growth agenda for a highly competitive green economy. So our financial needs, both official and private, have virtually quadrupled. So that’s problem others also have to face. Then I would say following the conclusion of the negotiations with the IMF and the successful approval of the Extended Fund Facility (EFF), we have had no roadmap to follow regarding the next phase of debt restructuring. So before we can get the next tranche from the IMF. So it’s a question of us now mapping the road out.

But I would like to certainly point out a few of the experiences. The data-led approach was the key to our success. It was our program, not an IMF program.

Secondly, we found a sponsor for us among the official creditor community. That helps. Thirdly, you have to be very pragmatic when you are implementing this. I’m not sure that a binding framework like the common framework would have rendered the process quicker or more efficient. The approach for a middle-income country would be to move. If you have a common framework, what happens is we move as fast as the slowest creditor.

So we get tied down. So that’s why we are not in favor of a common framework. We were able to create traction with the most committed creditors, raising the general quality and efficiency of the process. Because we are still frustrated by the lack of process.

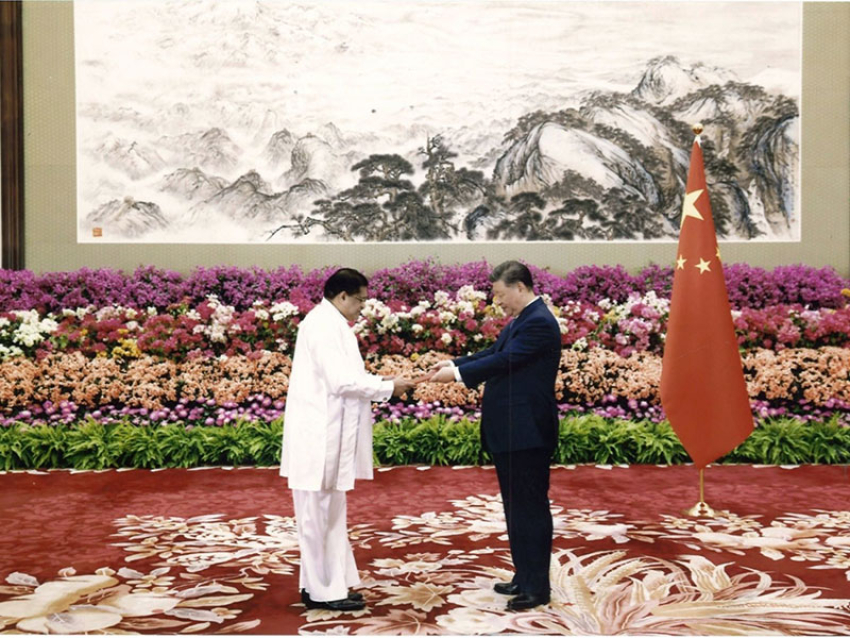

The cost for us, economic and social, has been very high. Now, as far as the creditors, our creditors include the Paris Club and the non-Paris Club members of which India and China are two of our main creditors, and Japan from the Paris Club.

So we’ve attempted to establish an ad hoc platform for the official creditors, including the Paris Club members and others. India, Hungary, and others came on to participate in the ad hoc platform.

China participated as an observer. We shared the information with all parties on an open transaction, a transparent process. Then I must thank IMF for the intervention of the IMF and Sri Lanka’s coordination, we are dealing with both groups. So what else helped us was that Sri Lanka had ongoing negotiations with Japan, India, and China separately regarding further trade integration and also some of the development programs for the future.

This assisted our process. But as far as my experience is, we need, we have to have some improvement in the interaction between the committee and the debtors because the debt restructuring process is a negotiation and it should in essence be interactive. Looking at the dealing with the Paris Club and non-Paris Club, we need a new approach because this is basically a geopolitical issue.

The mistrust between the US and China and the growing tension, it has to be addressed by all, not merely by Sri Lanka or the country concerned. If you do not resolve it, I think we will still, in Asia and Africa, we will get caught into another situation, not our making. So these will be the major issues that we have addressed.

And restructuring is needed. I agree with it. It has to move fast, otherwise, most countries, whether low-income countries or middle-income countries, will not have much hope and there will be more instability, political and economic instability. And without creating a separate process under this roundtable, we should deal with the issues of middle-income countries because most are under stress. It’s better to deal with them under stress than when they are bankrupt. So that process has to evolve.