The Monetary Policy Board of the Central Bank of Sri Lanka, at its meeting held on 26 September 2024, decided to maintain the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank at their current levels of 8.25 per cent and 9.25 per cent, respectively. The Board arrived at this decision after carefully considering the recent and expected macroeconomic developments and possible risks and uncertainties on the domestic and global fronts with a view to ensuring that inflation aligns with the target of 5 per cent over the medium term, while enabling the economy to reach its maximum potential. The Board observed that inflation is likely to remain well below the target of 5 per cent over the next few quarters, potentially recording deflation in the immediate future driven by changes to administratively determined prices and easing of supply conditions.

Headline inflation is projected to remain below the inflation target in the near term

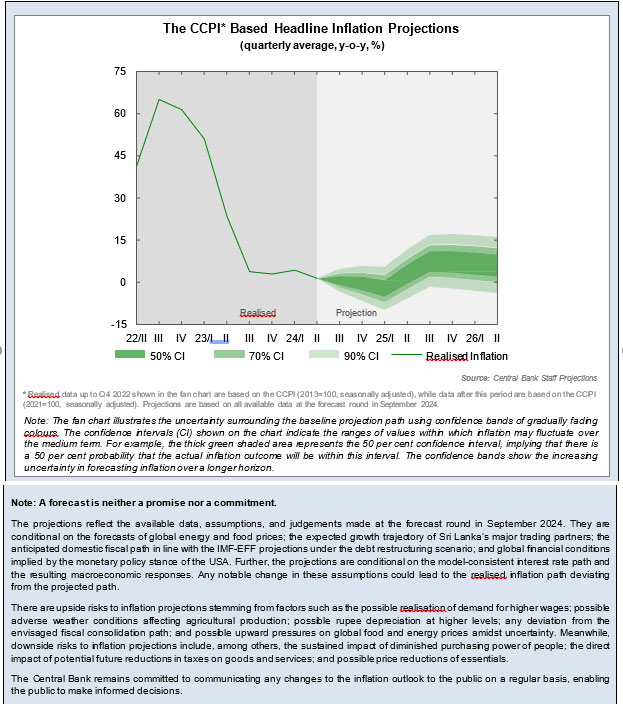

Headline inflation softened significantly with the recent downward revisions to the electricity tariffs, and fuel and LP gas prices as well as the overall decline in volatile food prices. Moreover, core inflation, which reflects underlying demand conditions in the economy, also moderated, albeit at a slower pace. Accordingly, the latest projections confirm that headline inflation is likely to be below the target by a notable margin in the forthcoming months while core inflation is projected to remain around the current levels on average. Supported by appropriate policy measures, inflation is expected to gradually align with the targeted level of 5 per cent over the medium term after a likely overshooting in the second half of 2025.

The recovery in domestic economic activity is expected to continue

As per the GDP estimates published by the Department of Census and Statistics (DCS), the economy is estimated to have grown by 4.7 per cent (year-on-year) in Q2 2024, following an expansion of 5.3 per cent (year-on-year) recorded in Q1 2024. The latest economic indicators suggest that the robust growth outcome recorded in the first half of 2024 is likely to continue through the remainder of the year resulting in a higher growth for 2024 than initially projected.

Overall downward adjustment in market lending interest rates continued

Market lending interest rates continued to decline in line with the current accommodative monetary policy stance. Along with this decline, credit to the private sector by Licensed Commercial Banks (LCBs) has expanded notably since May 2024, with sectoral data for Q2 2024 indicating a broad-based growth across all major economic sectors. Looking ahead, the expansion of credit to the private sector is expected to continue supported by lower market lending interest rates and the anticipated recovery in domestic economic activity. Meanwhile, yields on government securities, which came under pressure owing to perceived uncertainties amidst the Presidential election, showed preliminary signs of easing at the Treasury bill auction following the election.

The external sector remained robust thus far during the year

The merchandise trade deficit widened during the eight months ending August 2024 (provisional) compared to the same period in 2023, driven by a larger expansion in import expenditure relative to export earnings. Earnings from tourism and workers’ remittances improved during this period, strengthening the external current account. Meanwhile, despite intermittent volatility, the Sri Lanka rupee appreciated against the US dollar by over 7 per cent thus far during 2024, and the Central Bank purchased a significant amount of foreign exchange from the domestic market to bolster Gross Official Reserves (GOR). GOR stood at US dollars 6.0 billion (including the swap facility from the People’s Bank of China) at end August 2024. The continuation of the Extended Fund Facility arrangement with the International Monetary Fund (IMF-EFF) and early finalisation of the debt restructuring process will support the strengthening of external sector buffers further.

Policy interest rates are maintained at their current levels

In consideration of the current and expected macroeconomic developments including those highlighted above, the Monetary Policy Board of the Central Bank of Sri Lanka, at its meeting held on 26 September 2024, decided to maintain the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank at their current levels of 8.25 per cent and 9.25 per cent, respectively. The Board noted that the current accommodative monetary policy stance is yielding the expected outcomes, particularly in terms of the continued easing of market lending interest rates, expansion of credit to the private sector, and a strong rebound in domestic economic activity amidst a low inflation environment. The Monetary Policy Board will continue to monitor and assess incoming data on inflation developments and other macroeconomic variables and will adopt data-driven policies as required, going forward.

|

Monetary Policy Decision |

Policy interest rates and SRR unchanged |

|

|

Standing Deposit Facility Rate (SDFR) |

8.25% |

|

|

Standing Lending Facility Rate (SLFR) |

9.25% |

|

|

Statutory Reserve Ratio (SRR) |

2.00% |

INFORMATION NOTE:

A press conference, chaired by Governor Dr. P Nandalal Weerasinghe, will be held on 27 September 2024 at 11.30 am at the Atrium of the Central Bank of Sri Lanka, and proceedings will be livestreamed on Facebook and YouTube.

The release of the next regular statement on monetary policy review will be on 27 November 2024.

* Data Annexure is accessible at https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/mpr05_2024_e.pdf